Home » e4all

Category Archives: e4all

Find Your Passion and Become an Entrepreneur

Everyone has something they are passionate about doing. It could be anything from graphic design to cooking. Finding your passion is the first step towards becoming an entrepreneur, but it’s not always easy to find your true passions. Here are some tips to help you identify what makes you passionate and turn that into a successful business.

Do Your Research

Before you can even begin to think about becoming an entrepreneur, you need to do some research. What kind of businesses are out there? What type of companies and services do people need or want? Spend some time researching the market, reading up on industry trends, and getting a feel for what kind of business would be the most successful in your area.

Find Your Niche

Once you’ve done your research, it’s time to find your niche. Think about what sets you apart from other entrepreneurs in your field and how you can use that to your advantage. Do you have a unique skill or experience that can set you apart from the competition? Are there any specific products or services that only you can offer? Identifying your niche will help make sure that your business stands out from the crowd and gives customers a reason to choose you over someone else.

Make Connections

Networking is essential when it comes to being an entrepreneur. You need to make connections with other entrepreneurs in order to grow and succeed in business. Reach out to mentors who can provide guidance and advice based on their own experiences as entrepreneurs. Make sure that you also connect with potential customers so that they know who you are and what products or services you offer. Social media platforms like LinkedIn and Twitter are great tools for connecting with fellow entrepreneurs as well as potential clients.

Conclusion

Finding your passion is just one step towards becoming an entrepreneur but it’s an important one! Take some time to reflect on what makes you passionate and how that could translate into a successful business venture. Once you’ve identified what sets yourself apart from other entrepreneurs, start researching potential niches, making connections with mentors and potential customers, and get ready for success! With hard work, dedication, and determination anyone can become an entrepreneur—all it takes is finding something that inspires passion within them!

Funding for Diverse Founders

Small business loan options

There are several government lending programs and non-governmental organizations you should look into if you want a business loan option that prizes the work of minority entrepreneurs.

SBA 7(a) and 8(a) Development Program

A 7(a) loan through the Small Business Administration, a federal entity created to foster small business growth, is not exclusively for minority-owned organizations. That being said, minority business owners have a better chance of qualifying for these loans if they participate in SBA’s 8(a) Business Development program.

The 8(a) program helps “socially and economically disadvantaged entrepreneurs gain access to the economic mainstream of American society.” The 8(a) program can also help minority business owners gain access to the capital they need in case they don’t qualify for SBA’s 7(a) loan. Once accepted into the program, organizations hold membership for nine years. Check here for eligibility requirements.

SBA Community Advantage Loans

Also run by the SBA, The Community Advantage program offers financial assistance for businesses based in underserved markets and communities. The program is a good option for small business owners who are looking for a large amount of capital but do not qualify for traditional financing. Loans are offered up to $250,000. Take a look at your local SBA district office for more information on the program.

SBA Microloan Program

For minority-owned businesses that have smaller capital needs, the SBA Microloan program offers federal loans of $50,000 or less. These microloans are made by third-party lenders—usually nonprofit community-based organizations that also offer professional assistance to business owners. Check out your local SBA district office to find microloan options.

Accion U.S. Network

While these loans aren’t created specifically for minority business owners, they do target low- to moderate-income businesses that don’t usually qualify for traditional lending. This makes Accion a great option for minority business owners and new entrepreneurs. The nonprofit-lending network has organizations in 50 states offering loans from $200 up to $300,000.

Union Bank

For business owners with large capital needs, Union Bank offers financing for up to $2.5 million. The program is under the Equal Credit Opportunity Act, and is “designed to empower woman-, minority- and veteran-owned businesses,” according to its website. The business loans and lines of credit are exclusively for minority-owned businesses and owners must meet the bank’s designation of “minority,” which is the same as the EEOC’s.

Community Development Financial Institutions (CDFI)

CDFIs offer financial assistance to minority and economically distressed communities. Below are a few programs to consider:

- Native Initiatives is a CDFI that grants access to credit, capital and financial services to help Native Communities thrive and grow.

- The Business Center for New Americans is a CDFI that offers loans from $5,000 to $50,000 specifically to immigrants, refugees, women and other minority entrepreneurs. The organization is also focused on business owners who were turned down by a bank for a number of reasons that include the borrower’s credit score being too low or that the requested amount is too small. The best part: there is no minimum credit score required to qualify for a loan.

There are 950 CDFIs nationwide that are certified by the CDFI Fund, which is a part of the U.S. Department of the Treasury. Take a look at the CDFI Fund’s database to search for businesses in your area that have received awards.

Consider starting at the local level

Because many of the programs that provide funding to minority-owned businesses operate on the state or local level, getting to know the agencies in your community is a smart first step.

How else would you learn that the program WESST helps political refugees in New Mexico start businesses? You would also never know that the National African-American Small Business Loan Fund offers loans ranging from $35,000 to $250,000 to African American-owned small businesses in New York City, Chicago and Los Angeles.

Starting at the local level also helps you get to know the terrain better, and find people who can help you. Those people include mentors, advisors, lawyers and accountants. These working relationships can help you find lenders who provide loans to minorities in your industry. Get in touch with your local Chamber of Commerce or talk to a mentor to learn what local opportunities are available.

Don’t rule out business grants

Few things beat free, especially free money. Most small business grants are difficult to obtain due to the competition, but the following resources are worth exploring due to the fact that they are, well, free.

- Grants.gov provides information to more than 1,000 programs across 26 federal agencies that can help minority business owners tailor their search.

- The USDA Rural Business Enterprise Grant Program offers free money ranging from $10,000 to $500,000 for rural businesses. The money can be used for a number of purposes, including purchasing equipment, and acquisition and development of real estate. To qualify, the business must employ no more than 50 employees and have less than $1 million in annual gross revenue. The business must also operate in an eligible rural area. Check out the USDA’s Rural Development state offices for more information on eligibility and the application.

- Partnerships for Opportunity, Workforce and Economic Revitalization Initiative (POWER) was started by President Obama to help businesses in communities that were hurt by changes in the power and coal industries. The initiative is congressionally funded and has awarded $94 million in 114 investments since its start. Take a look here for more information.

Why an Entrepreneur Trip

How can I help you…

I decided to pivot my EntrepreneurTrip Purpose after a weekend of contemplation. I think there is something beautiful to be had by helping.

I guess I’ve always been a kind of collector. Not so much of stuff but information and experiences. This realization hit me hard as I am about embark on this EntrepreneurTrip. I am thinking about how I could gather the stories of diverse communities of business and what similarities of entrepreneurship there are across the USA.

It does sound compelling especially for someone like me. Then it hit me, what am I giving (not just collecting). Good storytelling takes time and effort – that’s a gift.

A crafted story being more powerful makes sense as humans we like well crafted things. It may be appreciated by humans more than any other animal. Well prepared food, thoughtful clothing, and nuanced stories (even if they are often seen as similar).

Having it flow in live and in unedited form is not as palatable as the crafted version. I love creating live media and generally don’t look back too much. Knowing how I am, how can I do the most Good in the moment?

So I’m traveling across the country as so many have before, how do I create a well crafted experience that helps?

What do you think? [comment below]

I will be in 11 or so towns. No sponsors, no fanfare, just gathering and listening. What’s the point? What’s it for? How does it help?

If I just decided to do one good thing in each town instead, would that be better?

I am now intent on seeing what doing good feels and looks like in entrepreneurship – not as social entrepreneurship but as caring in communities of founders. What does specific and directed caring look like for the business owners and me.

Join the EntrepreneurTrip Slack Channel to see what goes on with our community of care and compassion for founders.

We are on Facebook (primary live video interviews and partner organization updates), Instagram @entrepTrip (fun visuals from Trip and behind the scenes), and Twitter @entrepTrip (related articles, quotes from interviews, behind the scenes.

Entrepreneurship for All

Young people with the potential to become business leaders are too often unable to get past the disadvantages of poverty and a lack of access to knowledge and support.

Look in any low-income area, whether it’s a favela or a rural village or a run-down section of an American city, and you’ll find young people with the characteristics needed for entrepreneurship: curiosity, confidence, and a propensity to break rules. The latter trait is an important part of the mix. In a study by the National Bureau of Economic Research, young people who engaged in “more aggressive, illicit, risk-taking activities” tended to score higher on learning-aptitude tests, had greater self-esteem than their peers, and were more likely to undertake entrepreneurship ventures as adults.

It makes sense that rule-breakers are well-positioned to start businesses. Entrepreneurs are more comfortable setting their own rules than staying within limits set by others, and they often have little respect for authority — educational, cultural, or even legal.

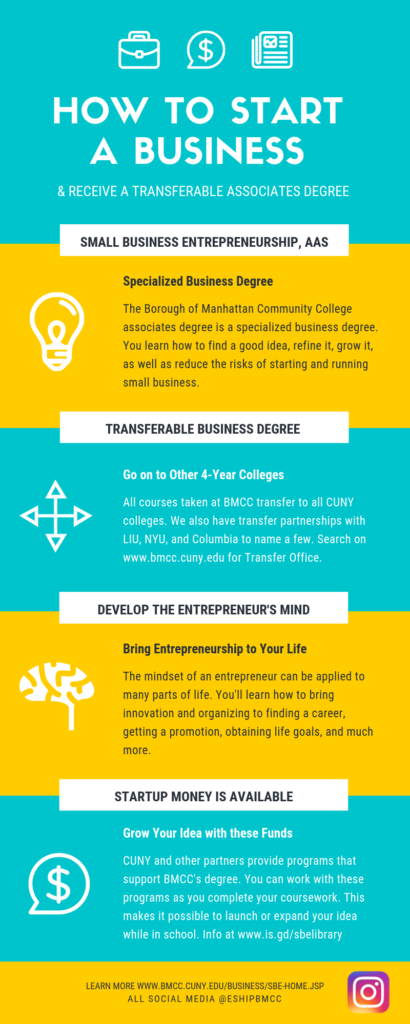

Often they do not have the skills or awareness of what is around them even if they grow up in a big place like New York City. Everything is available but if you do not know how to organize it, the cards are stacked against the new entrepreneur. BMCC’s Small Business & Entrepreneurship Degree Program gives you insights into how to think, act and organize like a company founder.

Recent Comments