Home » 2019

Yearly Archives: 2019

Funding for Diverse Founders

Small business loan options

There are several government lending programs and non-governmental organizations you should look into if you want a business loan option that prizes the work of minority entrepreneurs.

SBA 7(a) and 8(a) Development Program

A 7(a) loan through the Small Business Administration, a federal entity created to foster small business growth, is not exclusively for minority-owned organizations. That being said, minority business owners have a better chance of qualifying for these loans if they participate in SBA’s 8(a) Business Development program.

The 8(a) program helps “socially and economically disadvantaged entrepreneurs gain access to the economic mainstream of American society.” The 8(a) program can also help minority business owners gain access to the capital they need in case they don’t qualify for SBA’s 7(a) loan. Once accepted into the program, organizations hold membership for nine years. Check here for eligibility requirements.

SBA Community Advantage Loans

Also run by the SBA, The Community Advantage program offers financial assistance for businesses based in underserved markets and communities. The program is a good option for small business owners who are looking for a large amount of capital but do not qualify for traditional financing. Loans are offered up to $250,000. Take a look at your local SBA district office for more information on the program.

SBA Microloan Program

For minority-owned businesses that have smaller capital needs, the SBA Microloan program offers federal loans of $50,000 or less. These microloans are made by third-party lenders—usually nonprofit community-based organizations that also offer professional assistance to business owners. Check out your local SBA district office to find microloan options.

Accion U.S. Network

While these loans aren’t created specifically for minority business owners, they do target low- to moderate-income businesses that don’t usually qualify for traditional lending. This makes Accion a great option for minority business owners and new entrepreneurs. The nonprofit-lending network has organizations in 50 states offering loans from $200 up to $300,000.

Union Bank

For business owners with large capital needs, Union Bank offers financing for up to $2.5 million. The program is under the Equal Credit Opportunity Act, and is “designed to empower woman-, minority- and veteran-owned businesses,” according to its website. The business loans and lines of credit are exclusively for minority-owned businesses and owners must meet the bank’s designation of “minority,” which is the same as the EEOC’s.

Community Development Financial Institutions (CDFI)

CDFIs offer financial assistance to minority and economically distressed communities. Below are a few programs to consider:

- Native Initiatives is a CDFI that grants access to credit, capital and financial services to help Native Communities thrive and grow.

- The Business Center for New Americans is a CDFI that offers loans from $5,000 to $50,000 specifically to immigrants, refugees, women and other minority entrepreneurs. The organization is also focused on business owners who were turned down by a bank for a number of reasons that include the borrower’s credit score being too low or that the requested amount is too small. The best part: there is no minimum credit score required to qualify for a loan.

There are 950 CDFIs nationwide that are certified by the CDFI Fund, which is a part of the U.S. Department of the Treasury. Take a look at the CDFI Fund’s database to search for businesses in your area that have received awards.

Consider starting at the local level

Because many of the programs that provide funding to minority-owned businesses operate on the state or local level, getting to know the agencies in your community is a smart first step.

How else would you learn that the program WESST helps political refugees in New Mexico start businesses? You would also never know that the National African-American Small Business Loan Fund offers loans ranging from $35,000 to $250,000 to African American-owned small businesses in New York City, Chicago and Los Angeles.

Starting at the local level also helps you get to know the terrain better, and find people who can help you. Those people include mentors, advisors, lawyers and accountants. These working relationships can help you find lenders who provide loans to minorities in your industry. Get in touch with your local Chamber of Commerce or talk to a mentor to learn what local opportunities are available.

Don’t rule out business grants

Few things beat free, especially free money. Most small business grants are difficult to obtain due to the competition, but the following resources are worth exploring due to the fact that they are, well, free.

- Grants.gov provides information to more than 1,000 programs across 26 federal agencies that can help minority business owners tailor their search.

- The USDA Rural Business Enterprise Grant Program offers free money ranging from $10,000 to $500,000 for rural businesses. The money can be used for a number of purposes, including purchasing equipment, and acquisition and development of real estate. To qualify, the business must employ no more than 50 employees and have less than $1 million in annual gross revenue. The business must also operate in an eligible rural area. Check out the USDA’s Rural Development state offices for more information on eligibility and the application.

- Partnerships for Opportunity, Workforce and Economic Revitalization Initiative (POWER) was started by President Obama to help businesses in communities that were hurt by changes in the power and coal industries. The initiative is congressionally funded and has awarded $94 million in 114 investments since its start. Take a look here for more information.

Why an Entrepreneur Trip

How can I help you…

I decided to pivot my EntrepreneurTrip Purpose after a weekend of contemplation. I think there is something beautiful to be had by helping.

I guess I’ve always been a kind of collector. Not so much of stuff but information and experiences. This realization hit me hard as I am about embark on this EntrepreneurTrip. I am thinking about how I could gather the stories of diverse communities of business and what similarities of entrepreneurship there are across the USA.

It does sound compelling especially for someone like me. Then it hit me, what am I giving (not just collecting). Good storytelling takes time and effort – that’s a gift.

A crafted story being more powerful makes sense as humans we like well crafted things. It may be appreciated by humans more than any other animal. Well prepared food, thoughtful clothing, and nuanced stories (even if they are often seen as similar).

Having it flow in live and in unedited form is not as palatable as the crafted version. I love creating live media and generally don’t look back too much. Knowing how I am, how can I do the most Good in the moment?

So I’m traveling across the country as so many have before, how do I create a well crafted experience that helps?

What do you think? [comment below]

I will be in 11 or so towns. No sponsors, no fanfare, just gathering and listening. What’s the point? What’s it for? How does it help?

If I just decided to do one good thing in each town instead, would that be better?

I am now intent on seeing what doing good feels and looks like in entrepreneurship – not as social entrepreneurship but as caring in communities of founders. What does specific and directed caring look like for the business owners and me.

Join the EntrepreneurTrip Slack Channel to see what goes on with our community of care and compassion for founders.

We are on Facebook (primary live video interviews and partner organization updates), Instagram @entrepTrip (fun visuals from Trip and behind the scenes), and Twitter @entrepTrip (related articles, quotes from interviews, behind the scenes.

Basic accounting terms, acronyms, abbreviations and concepts to remember

Check out these basic accounting definitions and start to commit them to memory. That way, when you start thinking about your small business bookkeeping, you’ll already feel like you’re a step ahead and speaking the language.

1. Accounts receivable (AR)

Accounts receivable (AR) definition: The amount of money owed by customers or clients to a business after goods or services have been delivered and/or used.

2. Accounting (ACCG)

Accounting (ACCG) definition: A systematic way of recording and reporting financial transactions for a business or organization.

3. Accounts payable (AP)

Accounts payable (AP) definition: The amount of money a company owes creditors (suppliers, etc.) in return for goods and/or services they have delivered.

4. Assets (fixed and current) (FA, CA)

Assets (fixed and current) definition: Current assets (CA) are those that will be converted to cash within one year. Typically, this could be cash, inventory or accounts receivable. Fixed assets (FA) are long-term and will likely provide benefits to a company for more than one year, such as a real estate, land or major machinery.

5. Asset classes

Asset class definition: An asset class is a group of securities that behaves similarly in the marketplace. The three main asset classes are equities or stocks, fixed income or bonds, and cash equivalents or money market instruments.

6. Balance sheet (BS)

Balance sheet (BS) definition: A financial report that summarizes a company’s assets (what it owns), liabilities (what it owes) and owner or shareholder equity, at a given time.

7. Capital (CAP)

Capital (CAP) definition: A financial asset or the value of a financial asset, such as cash or goods. Working capital is calculated by taking your current assets subtracted from current liabilities—basically the money or assets an organization can put to work.

8. Cash flow (CF)

Cash flow (CF) definition: The revenue or expense expected to be generated through business activities (sales, manufacturing, etc.) over a period of time.

9. Certified public accountant (CPA)

Certified public accountant (CPA) definition: A designation given to an accountant who has passed a standardized CPA exam and met government-mandated work experience and educational requirements to become a CPA.

10. Cost of goods sold (COGS)

Cost of goods sold (COGS) definition: The direct expenses related to producing the goods sold by a business. The formula for calculating this will depend on what is being produced, but as an example this may include the cost of the raw materials (parts) and the amount of employee labor used in production.

11. Credit (CR)

Credit (CR) definition: An accounting entry that may either decrease assets or increase liabilities and equity on the company’s balance sheet, depending on the transaction. When using the double-entry accounting method there will be two recorded entries for every transaction: A credit and a debit.

12. Debit (DR)

Debit (DR) definition: An accounting entry where there is either an increase in assets or a decrease in liabilities on a company’s balance sheet.

13. Diversification

Diversification definition: The process of allocating or spreading capital investments into varied assets to avoid over-exposure to risk.

14. Enrolled agent (EA)

Enrolled agent (EA) definition: A tax professional who represents taxpayers in matters where they are dealing with the Internal Revenue Service (IRS).

15. Expenses (fixed, variable, accrued, operation)

Expenses (FE, VE, AE, OE) definition: The fixed, variable, accrued or day-to-day costs that a business may incur through its operations.

- Fixed expenses (FE): payments like rent that will happen in a regularly scheduled cadence.

- Variable expenses (VE): expenses, like labor costs, that may change in a given time period.

- Accrued expense (AE):an incurred expense that hasn’t been paid yet.

- Operation expenses (OE): business expenditures not directly associated with the production of goods or services—for example, advertising costs, property taxes or insurance expenditures.

16. Equity and owner’s equity (OE)

Equity and owner’s equity (OE) definition: In the most general sense, equity is assets minus liabilities. An owner’s equity is typically explained in terms of the percentage of stock a person has ownership interest in the company. The owners of the stock are known as shareholders.

17. Insolvency

Insolvency definition: A state where an individual or organization can no longer meet financial obligations with lender(s) when their debts come due.

18. Generally accepted accounting principles (GAAP)

Generally accepted accounting principles (GAAP) definition: A set of rules and guidelines developed by the accounting industry for companies to follow when reporting financial data. Following these rules is especially critical for all publicly traded companies.

19. General ledger (GL)

General ledger (GL) definition: A complete record of the financial transactions over the life of a company.

20. Trial balance

Trial balance definition: A business document in which all ledgers are compiled into debit and credit columns in order to ensure a company’s bookkeeping system is mathematically correct.

21. Liabilities (current and long-term)

Liabilities (current and long-term) definition: A company’s debts or financial obligations incurred during business operations. Current liabilities (CL) are those debts that are payable within a year, such as a debt to suppliers. Long-term liabilities (LTL) are typically payable over a period of time greater than one year. An example of a long-term liability would be a multi-year mortgage for office space.

22. Limited liability company (LLC)

Limited liability company (LLC) definition: An LLC is a corporate structure where members cannot be held accountable for the company’s debts or liabilities. This can shield business owners from losing their entire life savings if, for example, someone were to sue the company.

23. Net income (NI)

Net income (NI) definition: A company’s total earnings, also called net profit. Net income is calculated by subtracting total expenses from total revenues.

24. Present value (PV)

Present value (PV) definition: The current value of a future sum of money based on a specific rate of return. Present value helps us understand how receiving $100 now is worth more than receiving $100 a year from now, as money in hand now has the ability to be invested at a higher rate of return. See an example of the time value of money here.

25. Profit and loss statement (P&L)

Profit and loss statement (P&L) definition: A financial statement that is used to summarize a company’s performance and financial position by reviewing revenues, costs and expenses during a specific period of time, such as quarterly or annually.

26. Return on investment (ROI)

Return on investment (ROI) definition: A measure used to evaluate the financial performance relative to the amount of money that was invested. The ROI is calculated by dividing the net profit by the cost of the investment. The result is often expressed as a percentage. See an example here.

27. Individual retirement account (IRA, Roth IRA)

Individual retirement account (IRA) definition: IRAs are savings vehicles for retirement. A traditional IRA allows individuals to direct pre-tax dollars toward investments that can grow tax-deferred, meaning no capital gains or dividend income is taxed until it is withdrawn, and, in most cases, it’s tax deductible. Roth IRAs are not tax-deductible; however, eligible distributions are tax-free, so as the money grows, it is not subject to taxes upon withdrawals.

28. 401K & Roth 401K

401k & Roth 401k definition: A 401K is a savings vehicle that allows an employee to defer some of their compensation into an investment-based retirement account. The deferred money is usually not subject to tax until it is withdrawn; however, an employee with a Roth 401K can make contributions after taxes. Additionally, some employers choose to match the contributions made by their employees up to a certain percentage.

29. Subchapter S corporation (S-CORP)

Subchapter S corporation (S-CORP) definition: A form of corporation (that meets specific IRS requirements) and has the benefit of being taxed as a partnership versus being subject to the “double taxation” of dividends with public companies.

30. Bonds and coupons (B&C)

Bonds and coupons (B&C) definition: A bond is a form of debt investment and is considered a fixed income security. An investor, whether an individual, company, municipality or government, loans money to an entity with the promise of receiving their money back plus interest. The “coupon” is the annual interest rate paid on a bond.

STEM to STEAM to STEAME: Science to Art to Entrepreneurship

Without question, STEM (science, technology, engineering, and mathematics) is the new buzzword for those worried about post-graduation employment. These are all disciplines in which students could excel if they are to retain their industrial and economic strength through a lifetime of work.

In his February 2013 State of the Union address, President Obama urged that we double-down on science and technology education starting in our secondary schools. To give the argument even more traction, some would widen the list of STEM professions to include educators, technicians, managers, social scientists, and health care professionals. Indeed, the talk these days in my college is about how to engage the 50%+ who study liberal arts in the 2-year programs.

According to the U.S. Department of Commerce, the STEM job sector is growing at twice the rate of non-STEM occupations, but we should note some caveats. First, let’s remember that STEM workers, as identified by the Commerce Department, comprise only 5.5% of the workforce. Second, while STEM workers overall may earn 26% more than their counterparts, the greatest differential is seen in the lowest-level jobs; the higher the terminal degree, the less the earnings difference.1

Why Art & Entrepreneurship

Therefore, we have to bring students into the power of their mindset. In particular, the entrepreneurial way of seeing problems and solutions. It’s not just thinking outside the box, it’s thinking of practical solutions that solve quickly and innovatively the problem. Many businesses do not have months and month or year to solve problems.

Take Stephen Northcutt, a 4-year college grad, who is now the president and CEO of The Escal Institute of Advanced Technologies. Before he began working in computer security, before he even went to college, Stephen was a Navy helicopter rescue crewman. Later, he became a whitewater raft guide, a chef, an instructor in the martial arts, a cartographer, and a network designer. Stephen came to college to study geology, but then he became intrigued by geodetics, or global mapping. His real strength, it turns out, was not in the technical arena. As one of Stephen’s professors said, “Stephen’s real strong point was being able to examine the situation and know what to do.” This means he had an entrepreneurial mind.

STEM is AI & STEAME is Humanity

When we add art and business, we immediately complicate basic machine learning. The brain is an amazing adaptive instrument that can make music, art, and expand on physics. Going into the increasingly technical world of work requires that integrate art and entrepreneurship into our educations system so that we can simple and clever solutions to complex problem. And of course complex solutions to complex problems. But heavens not—complex solutions to simple problems (bad tech can do that too).

When we focus in on STEM+AE, we can marry what our minds do best with the dynamic and intriguing work-world.

Moreover, it is not a given that the only path to STEM job success is to attain a STEM degree. About one-third of college-educated workers in STEM professions do not hold degrees in STEM. Two-thirds of people holding STEM undergraduate degrees work in non-STEM jobs. One-fifth of math majors, for instance, end up working in education.2 Nearly 40% of STEM managers hold non-STEM degrees.3 This data points to one of the realities of college and career: the workplace is flexible, vibrant, and often unpredictable—a moving target, if you will. It is a place where, over a lifetime, a college graduate will hold multiple jobs and may even see multiple careers.4 An entrepreneurially minded person in that job market will be able to adapt more quickly.

Numerous biographies of technology executives illustrate that even in the tech fields, the rise to the top is facilitated by non-tech degrees. A study of technology company startups by researchers at Harvard and Duke found that 47% of their CEOs and CTOs had terminal degrees in STEM subjects, but 53% had degrees in a variety of other fields—including finance, arts and humanities, business, law, and health care.5

Moreover, the CEOs of Dell, JP Morgan Chase, Walt Disney, IBM, and FedEx all have liberal arts educations.6

Why is this? We think it’s because the people who run things—whether divisions, departments, companies, or state governments—are integrators and synthesizer—and entrepreneurs.

So who brings together the scientists, the engineers, the designers, and humanists? I think you know by now what I believe. Not every one of our graduates will go on to be a Steve Jobs, but we know that they will be bigger, broader, and more creative and fearless thinkers and doers. That’s what community colleges need most.

Fun Video about STEAM…

BMCC Portfolio of Entrepreneurial Activities. Come Join us!

BMCC has a robust collection of resources and projects available to help students connect to entrepreneurial thinking. We welcome new students, existing business owners, partners and sponsors for these program. Check out what we are doing and connect to us!

We are also on all social media @eshipBMCC.

Poster Presentation at CUNY Games Conference

The CUNY Games Network of the City University of New York is excited to announce The CUNY Games Conference 5.0, to be held on January 18, 2019, at the Borough of Manhattan Community College in New York City.

R. Shane Snipes will be presenting a poster on Mindfulness, Technology, and Business Simulations.

In Fall 2018, BMCC’s Small Business & Entrepreneurship (SBE) 100 course used mindfulness interventions and the VentureBlocks.com simulation to increase student empathy for customer need, reduce student stress in interacting with new customers, and observing new potential business ideas based on customer interaction.

Pedagogically, mindful behaviors and access to useful teaching tech (EdTech) through games:

MINDFULNESS

- Agree to the purpose and hopeful outcome

- Pause to create “entry moment” for use of tech

- Reduced distraction (framed as “focus training”)

- Use in conjunction with www.FLIPDapp.co to manage & incentivize better tech usage

GAMING / VENTUREBLOCKS

- Customer discovery process & EMPATHY practice

- Teaching empathy in action / with a business purpose

- Foundational entrepreneurship knowledge/skill

- Healthy competition

Feedback

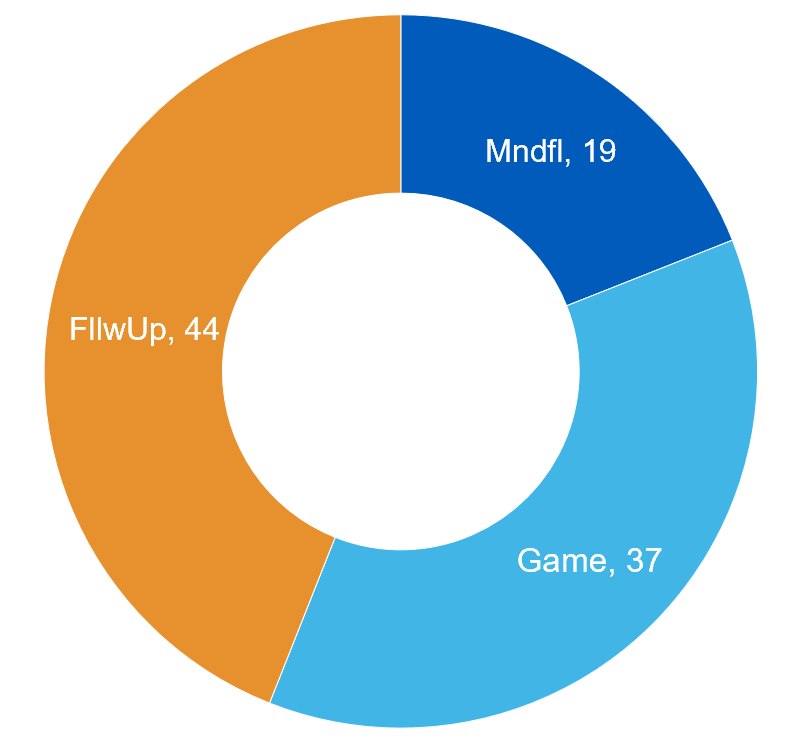

Students offered feedback on the game and the mindfulness (focus training). Which was most useful? [See Figure]:

A. Mindfulness (focus training and app) most useful.

B. Game most useful in learning the concepts of customer discovery.

C. Follow up on the simulation play the next class was most useful.

More about Games Conference – This year, the CUNY Games Conference distills its best cutting-edge interactive presentations into a one-day event to promote and discuss game-based pedagogies in higher education, focusing particularly on non-digital learning activities that faculty can use in the classroom every day. The conference will include workshops led by CUNY Games Organizers on how to modify existing games for the classroom, how to incorporate elements of play into simulations and critical thinking activities, as well as poster sessions, playtesting, and gameplay. For the digitally minded, we will also offer a workshop in creating computer games in Unity.

Visit other research here.

Recent Comments